Oman’s smart home ecosystem is entering a transformative growth phase — shifting from basic device adoption to fully integrated, intelligent living driven by 5G expansion, energy digitalization, and rising consumer appetite for home automation.

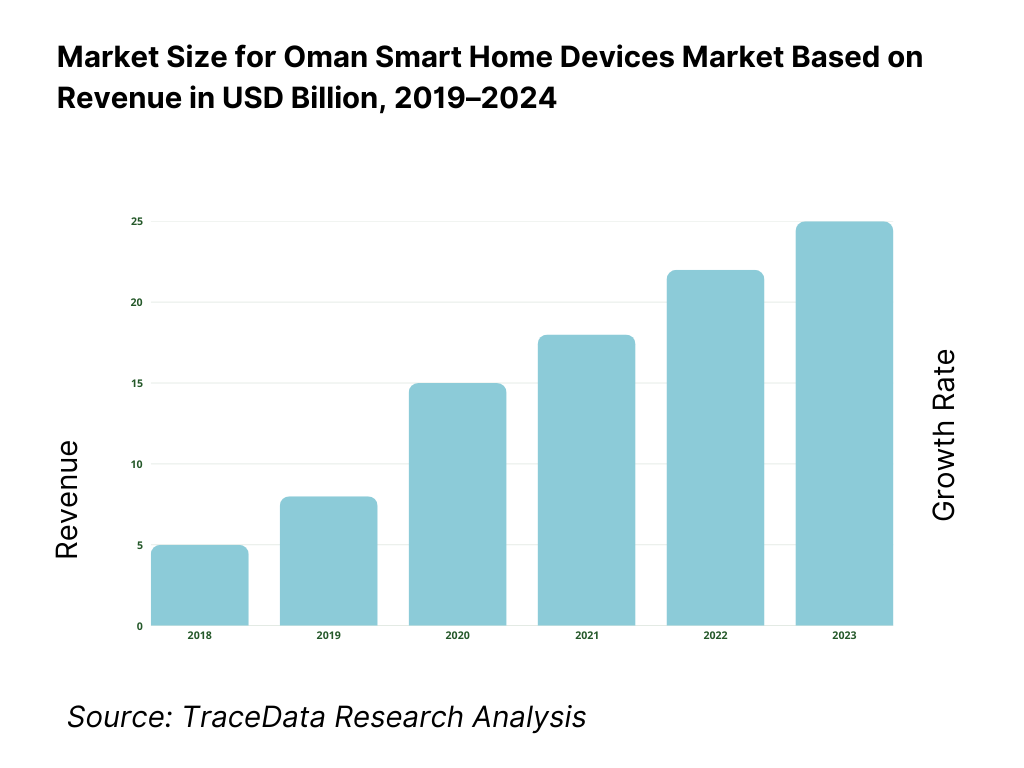

According to TraceData Research’s latest report, “Oman Smart Home Devices Market Outlook to 2030,” the broader Middle East & Africa smart home devices market is valued at USD 2,456.1 million, with Oman contributing a significant and fast-growing share. Demand is being propelled by smart meter rollout, developer-led villa automation, and the expansion of modern retail and e-commerce.

What’s Driving the Shift?

Dense digital rails enabling seamless device onboarding

Oman’s connectivity backbone reduces friction in adopting smart devices.

- 6.35 million mobile subscriptions

- 5.34 million mobile-broadband users

- 582,000 fixed-broadband lines

- 920 million OMR telecom revenue

This digital infrastructure supports always-on devices — cameras, hubs, thermostats, lighting systems — enabling scalable Wi-Fi and IP-connected smart home ecosystems across both Muscat’s residential hubs and emerging towns.

Household scale, urban concentration & rising purchasing power

With a population of 5.27 million and an economy worth USD 105.19 billion, Oman hosts a rapidly growing residential base. Urban clusters like Muscat, Seeb, Al Rusayl, and Al Batinah dominate adoption due to higher disposable incomes, dense housing handovers, and strong retail availability. Imports worth USD 47.4 billion ensure continuous device supply across retail and online channels.

Grid digitalization & smart metering driving energy use-cases

Oman has installed 1.13 million electricity smart meters, creating a foundation for energy dashboards, sub-metering, load scheduling, and climate control automation. With AC-driven electricity loads and rising energy prices, smart thermostats, plugs, and HVAC controllers are increasingly seen as essential.

Download the free sample report today and explore the data for yourself.

The Challenges Ahead

Service and installation gaps outside dense corridors

Only 582,000 households have fixed broadband access, creating disparities between Muscat/Dhofar and rural governorates. Limited technician availability in remote areas slows installation and maintenance for cameras, hubs, and lighting systems.

Import dependence and regulatory bottlenecks

Oman’s heavy reliance on imported electronics exposes brands to customs delays and Type Approval clearance cycles. Every Wi-Fi, Bluetooth, Zigbee, or Matter-enabled product must comply with TRA regulations, often postponing new launches or retail availability.

Data-handling obligations under Personal Data Protection Law

Under Royal Decree 6/2022, companies must ensure transparent consent, secure cloud processing, and lawful retention for video and sensor data collected by smart home devices. For camera-heavy ecosystems, compliance adds operational complexity.

The Future: Integrated Ecosystems, AI-Powered Automation & Smart Energy Homes

TraceData Research forecasts five major shifts shaping Oman’s market through 2030:

- Rise of unified hybrid ecosystems integrating lighting, HVAC, energy dashboards, and security automation

- AI-driven predictive climate control — vital for a country with average temperatures above 30°C

- Developer-led smart communities, embedding IoT wiring and automation into new villas and compounds

- Localized data practices & on-device processing enhancing consumer trust

- Expansion of smart solutions beyond homes — into industrial zones, logistics corridors, SOHO spaces, and public infrastructure

Oman’s strong economic base and expanding broadband footprint will continue driving device penetration across all dwelling types.

Get insights tailored to your business — request specific sections or data cuts from the report.

Leading Players in Oman’s Smart Home Devices Industry

The report features detailed profiles and competitive mapping of major device OEMs and integrators, including:

- Samsung SmartThings

- Xiaomi (Mi Home)

- Aqara

- Philips Hue (Signify)

- TP-Link (Tapo / Kasa)

- Ring (Amazon)

- Arlo Technologies

- eufy (Anker)

- Google Nest & Apple Home

- Yale (ASSA ABLOY)

- Schneider Electric (Wiser)

- Legrand / Netatmo

- Bosch Smart Home

- EZVIZ

Recent trends include Matter-enabled ecosystems, Arabic interface rollouts, GCC service hubs, and telco bundling pilots with Omantel and Ooredoo.

Why It Matters

Oman’s smart home landscape is no longer limited to cameras and gadgets — it is evolving into a connected lifestyle of energy efficiency, security, and automated living. For manufacturers, telecom operators, retailers, real-estate developers, utilities, and investors, this sector offers a high-growth opportunity to shape Oman’s next generation of residential and commercial spaces.

A rapidly digitalizing economy, expanding villa construction, and strong telco partnerships position Oman as one of the most promising smart home markets in the GCC.

Contact Us -

TraceData Research

sales@tracedataresearch.com

+91 9266849840