Global Off Highway Vehicles Market: Growth, Trends & Outlook (2025–2032)

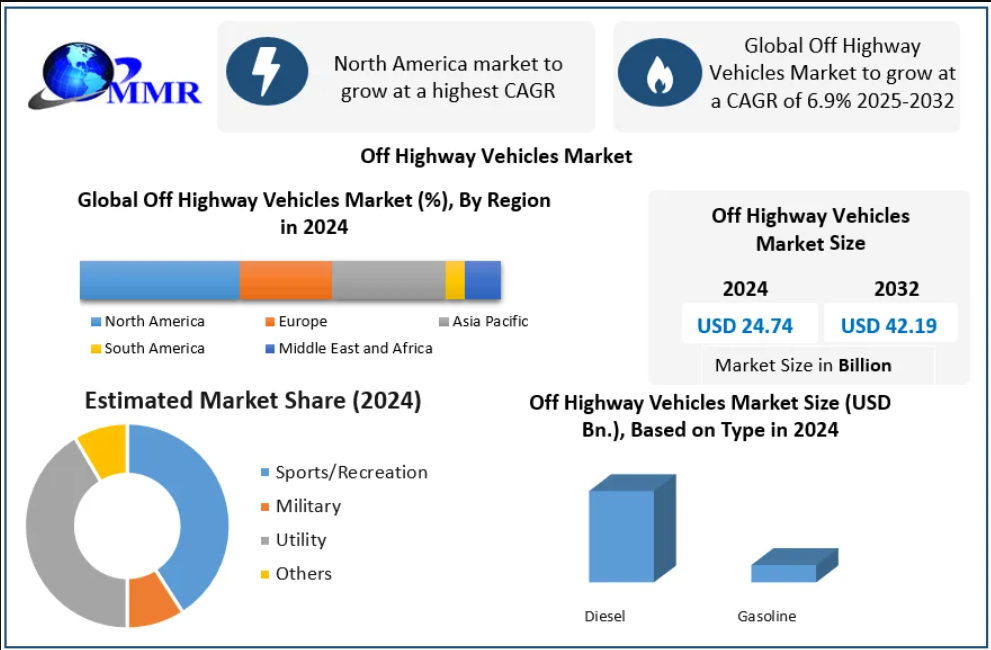

The Global Off-Highway Vehicles (OHV) Market, valued at USD 24.74 billion in 2024, is set for sustained growth, projected to reach USD 42.19 billion by 2032, expanding at a CAGR of 6.9%. This rapid rise is driven by massive investments in infrastructure development, smart agriculture, automation, and clean-energy technologies across global markets.

Off-highway vehicles—such as excavators, loaders, bulldozers, tractors, and autonomous mining trucks—play a crucial role in construction, mining, forestry, agriculture, and military applications. As nations accelerate urbanization and shift toward sustainable infrastructure, demand for high-performance OHVs continues to grow.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/74216/

Market Overview

Off-highway vehicles are designed to execute heavy-duty operations away from public roadways. These machines deliver value in some of the world’s most demanding environments—from deep underground mining sites to large-scale agricultural fields. The market is undergoing a major transformation as manufacturers integrate electrification, digitalization, telematics, and autonomous technologies.

By 2024, North America held the leading market share, supported by a robust construction pipeline, government-backed infrastructure funding, and rapid adoption of smart OHV technologies.

Key Market Dynamics

1. Urbanization & Infrastructure Expansion Driving Demand

Rapid modernization across North America, Asia-Pacific, Europe, and the Middle East is accelerating demand for construction equipment. Trends such as:

- Rising nuclear households

- Smart city development

- Increasing investments in commercial and residential infrastructure

- Growing need for efficient material handling

These developments are increasing reliance on OHVs such as graders, bulldozers, and loaders.

Leasing of equipment has also surged, making access more affordable for small and medium contractors.

2. Industrial Growth & Off-Road Transportation Fuel Opportunities

Emerging economies are investing heavily in:

- Industrial corridors

- Smart manufacturing zones

- Mining exploration

- Oil & gas projects

Modern OHVs are increasingly used in drilling, tunneling, quarrying, and hydroelectric projects. Advanced capabilities like hybrid engines, real-time analytics, and automated excavation systems are further enhancing efficiency.

Additionally, recreational OHVs (ATVs, UTVs, snowmobiles) are gaining traction due to increased consumer spending on adventure sports post-COVID.

3. Challenges: High Electrification Costs & Infrastructure Gaps

Despite growth, the market faces significant challenges:

- High costs associated with electric and autonomous OHVs

- Limited charging and hydrogen infrastructure for heavy machinery

- Supply chain delays in batteries, semiconductors, and hydraulic components

- Need for skilled operators and maintenance workforce

- Stricter environmental compliance requirements

These factors create entry barriers for small-scale manufacturers and slow adoption in developing markets.

Market Segmentation Highlights

By Fuel Type

• Gasoline – Dominant Segment (2024)

Gasoline-powered OHVs led the market due to:

- Lower upfront cost

- Simpler refueling infrastructure

- Preferred use in recreational and lighter-duty applications

• Diesel

Remains essential for heavy-duty construction and mining but is facing long-term transition pressure from electrification.

By Application

• Recreation – Leading Segment

Off-road recreational vehicles experienced a surge in popularity due to adventure tourism and increased disposable incomes.

• Military, Sports & Utility

Demand continues to grow in:

- Ground mobility solutions

- Search & rescue applications

- Utility management in rugged terrains

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/74216/

Regional Insights

North America – Global Leader

Drivers include:

- Massive U.S. infrastructure funding

- Precision agriculture adoption

- Strong presence of top-tier OEMs

- Push for electrification and automation

Europe

Europe remains a major market due to strict sustainability goals and innovations in hybrid construction equipment.

Countries like Germany, Sweden, and the UK drive adoption of:

- Electric excavators

- Hybrid loaders

- Telematics-enabled machinery

Asia-Pacific – Fastest Growing Region

Growth supported by:

- Large-scale construction in China and India

- Rising agriculture mechanization

- Increased mining exploration in Indonesia and Australia

- Expansion of local OEMs including XCMG, SANY, and Hitachi

Competitive Landscape

The OHV market is highly competitive with global OEMs leading innovation.

Major Players

- Caterpillar Inc. (USA)

- Komatsu Ltd. (Japan)

- Volvo CE (Sweden)

- Deere & Company (USA)

- CNH Industrial (USA/Italy)

- JCB Ltd. (UK)

- Liebherr Group (Germany)

Local and regional players in China, South Korea, and India also play a critical role in cost-competitive machinery.

Recent Industry Developments (2025)

- Caterpillar introduced next-gen autonomous haul trucks with advanced AI navigation.

- Komatsu launched an all-electric compact wheel loader for urban projects.

- Volvo CE unveiled a hybrid hydraulic excavator with 20% fuel savings.

- Deere & Company upgraded JDLink™ telematics for predictive maintenance.

- CNH Industrial acquired Hemisphere GNSS to strengthen precision guidance systems.

Conclusion

The Global Off-Highway Vehicles Market is undergoing a significant technological shift. With strong government funding, growing sustainability demands, and rapid urbanization, the market is positioned for robust expansion through 2032.

The transition toward electric, autonomous, and connected OHVs will define the future landscape—benefiting construction, agriculture, mining, military services, and recreational users worldwide.