Waterjet Cutting Machine Market: Global Industry Analysis and Forecast (2025–2032)

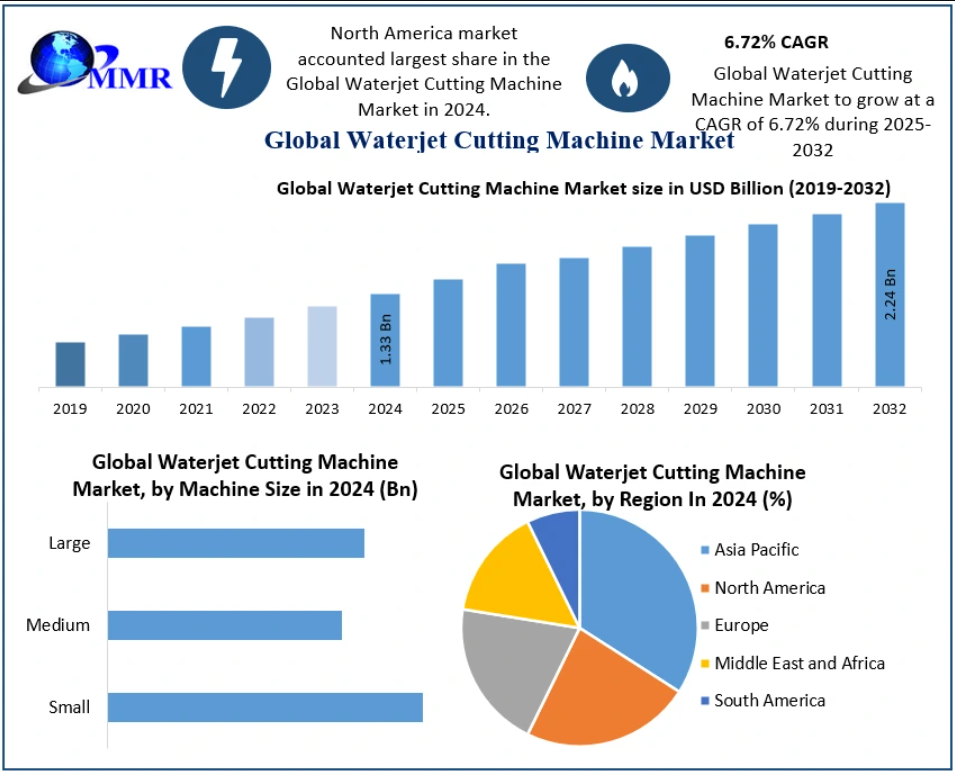

The global Waterjet Cutting Machine Market was valued at USD 1.33 billion in 2024 and is projected to reach approximately USD 2.24 billion by 2032, expanding at a CAGR of 6.72% from 2025 to 2032. The market’s growth is fueled by rising demand for precision cutting technologies, increasing automation across manufacturing industries, and the growing preference for environmentally sustainable cutting solutions.

Market Overview

Waterjet cutting machines utilize ultra-high-pressure water streams, often combined with abrasives, to cut a wide range of materials without generating heat. This cold-cutting process eliminates thermal distortion, preserves material integrity, and enables intricate and highly accurate cuts. These advantages make waterjet technology particularly suitable for applications requiring precision, versatility, and minimal material wastage.

Industries such as automotive, aerospace, metal fabrication, construction, electronics, and renewable energy increasingly rely on waterjet cutting for complex geometries and multi-material compatibility. The technology is capable of cutting metals, composites, ceramics, glass, stone, textiles, and plastics, positioning it as a flexible alternative to laser and plasma cutting systems.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/10882/

Market Drivers

One of the primary growth drivers of the Waterjet Cutting Machine Market is the integration of automation and robotics. Robotic waterjet systems significantly enhance production efficiency by enabling automated loading, unloading, and continuous cutting operations. For example, advanced robotic systems deployed in automotive and aerospace manufacturing ensure repeatable precision while reducing cycle times.

Another key factor driving market growth is the environmentally friendly nature of waterjet cutting. Unlike thermal cutting methods, waterjet systems do not emit harmful gases or create heat-affected zones, aligning with stringent environmental and safety regulations across developed and emerging economies.

Technological advancements in software optimization, AI-driven cutting path algorithms, and IoT-enabled monitoring are further improving machine accuracy, reducing material waste, and lowering operational downtime. These innovations are accelerating adoption across both large-scale industrial facilities and small-to-medium enterprises.

Technological Advancements and Competitive Developments

Over the past five years, leading manufacturers have introduced next-generation waterjet systems focused on higher speed, enhanced precision, and smarter operations. Companies such as Flow International Corporation, OMAX Corporation, Dardi International, KMT Waterjet Systems, and WardJet continue to invest heavily in R&D to maintain competitive advantage.

Innovations include five-axis cutting machines for complex geometries, eco-efficient pumping systems, compact entry-level models for smaller manufacturers, and AI-based software that optimizes cutting efficiency. Expansion into emerging markets such as India and China through partnerships and distribution networks is also strengthening global market penetration.

Market Restraints

Despite its advantages, the market faces several challenges. High initial capital investment, ranging from USD 200,000 to USD 500,000 for advanced systems, remains a significant barrier for small manufacturers. Additionally, operational expenses related to maintenance, abrasives, and consumables can account for 15–20% of the machine’s cost annually.

Technical limitations, including slower cutting speeds for very thick materials and challenges in multi-layer cutting, can impact productivity in certain applications. Moreover, waterjet systems generate wastewater that requires proper treatment and disposal, adding to operational costs. Noise levels between 80–90 decibels also necessitate additional workplace safety measures.

A shortage of skilled operators further affects machine utilization, with demand for trained technicians growing steadily. Compliance with evolving safety and environmental regulations continues to add cost and complexity for manufacturers and end users alike.

Segment Analysis

By product type, Robotic Waterjet Cutting Systems dominated the market in 2024 due to their extensive use in high-precision industries such as automotive and aerospace. Micro Waterjet Cutting is gaining traction in electronics and medical device manufacturing, where ultra-fine precision is critical. 3D Waterjet Cutting represents a fast-growing segment, enabling complex, customizable designs across architectural and industrial applications.

Based on application, the automotive industry holds the largest market share, driven by the need for precise and distortion-free cutting of vehicle components. Defense and aerospace sectors also benefit from waterjet versatility, although adoption is moderated by regulatory constraints. Metal fabrication, electronics, textiles, and interior decoration industries exhibit steady adoption as the technology matures and becomes more cost-effective.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/10882/

Regional Insights

North America dominates the global Waterjet Cutting Machine Market, supported by strong manufacturing infrastructure and the presence of leading players in the United States. Europe follows closely, driven by advanced industrial automation and sustainability initiatives.

The Asia-Pacific region is the fastest-growing and largest consuming market, led by rapid industrialization in China and India. Rising domestic production capabilities, coupled with increased imports of advanced machinery, are reshaping the regional competitive landscape. Meanwhile, the Middle East & Africa and South America are witnessing gradual adoption supported by infrastructure development and industrial diversification.

Competitive Landscape

The market remains highly competitive, with major players focusing on innovation, customization, and strategic expansion. Key companies include Flow International, OMAX Corporation, Jet Edge, WardJet, KMT Waterjet, Tecnocut, Resato International, STM Waterjet, Dardi International, and APW Waterjet. Continuous product innovation and strategic collaborations are expected to define competition over the forecast period.

Conclusion

The Waterjet Cutting Machine Market is poised for steady growth through 2032, driven by technological advancements, rising automation, and demand for precision and sustainable manufacturing solutions. While high costs and operational challenges persist, ongoing innovation and expanding applications across industries are expected to strengthen market adoption globally.