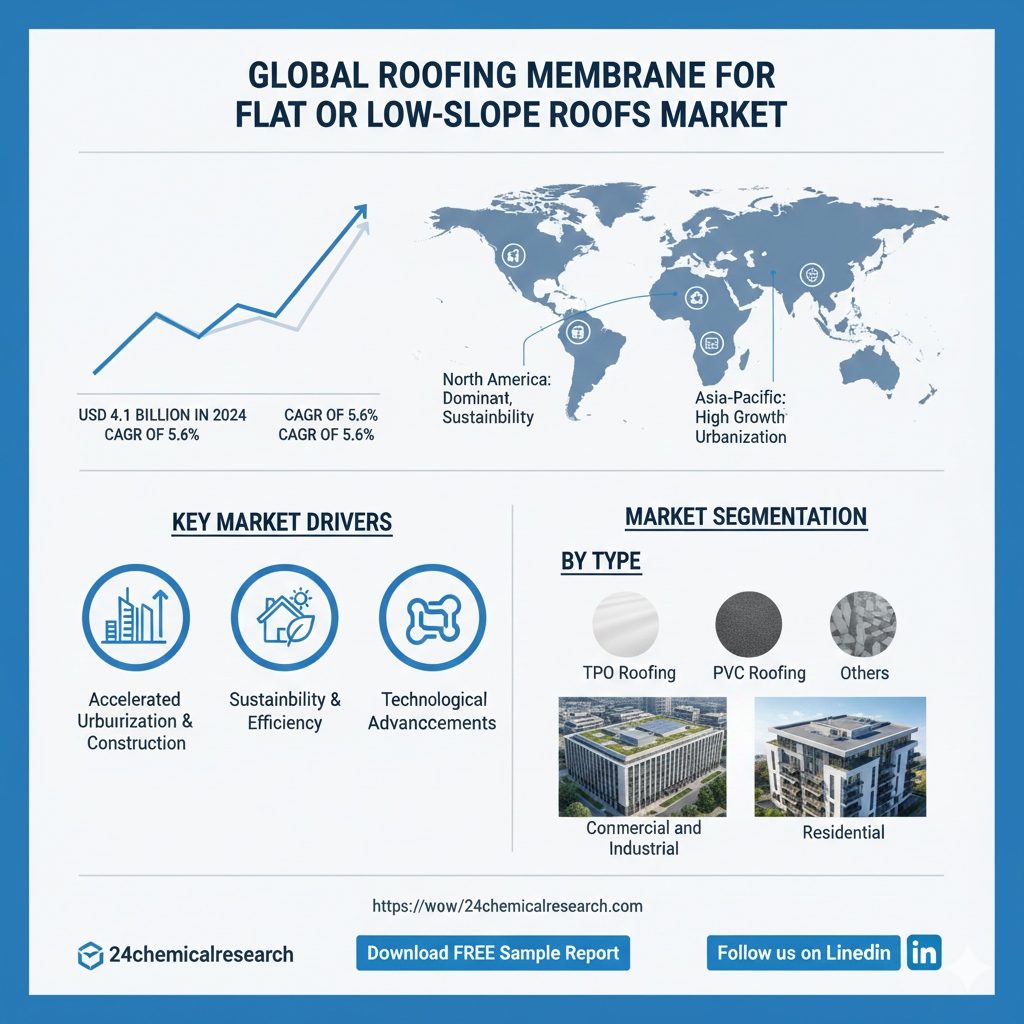

Global Roofing Membrane for Flat or Low-Slope Roofs market was valued at USD 4.1 billion in 2024 and is projected to reach USD 6.8 billion by 2032, exhibiting a steady CAGR of 5.6% during the forecast period.

Roofing membranes, engineered materials specifically designed to provide waterproofing and weather resistance for buildings with minimal pitch, have evolved from basic protective layers into sophisticated systems that enhance building performance and sustainability. Their versatility—including exceptional durability, resistance to UV radiation and thermal extremes, and flexibility—makes them essential components for modern construction infrastructure. Unlike traditional built-up roofing systems, modern single-ply membranes offer simplified installation and superior long-term performance, facilitating their integration across diverse architectural projects and climatic conditions.

Get Full Report Here: https://www.24chemicalresearch.com/reports/167788/global-roofing-membrane-for-flat-or-lowslope-roofs-market-2028-521

Market Dynamics:

The market's trajectory is shaped by a complex interplay of powerful growth drivers, significant restraints that are being actively addressed, and vast, untapped opportunities.

Powerful Market Drivers Propelling Expansion

- Accelerated Urbanization and Commercial Construction: The relentless expansion of metropolitan areas globally is the single largest catalyst for roofing membrane demand. The global urban population is projected to reach 5.2 billion by 2030, demanding vast new commercial spaces. Globally, the commercial construction sector, valued at over $7.2 trillion, drives consistent demand for flat roof solutions in office complexes, shopping malls, warehouses, and institutional buildings. Membranes have become the default specification for new low-slope construction because they provide a seamless, durable barrier that can easily accommodate the large footprint of these structures. Furthermore, the rise of mega-logistics hubs and data centers, which exclusively utilize flat roofs for their operational efficiency, has created a resilient and expanding market base.

- Sustainability and Energy Efficiency Imperatives: The building industry is undergoing a transformation driven by green building standards and increasingly stringent energy codes. Cool roofing membranes, which reflect a significant portion of solar radiation, can reduce rooftop surface temperatures by as much as 20-30°C. This directly translates into a 10-15% reduction in cooling energy consumption for buildings, making them highly attractive in an era of rising energy costs. The global green building market, expected to surpass $1 trillion by 2030, positions high-performance membranes as critical contributors to environmental goals and operational savings, thereby accelerating their adoption.

- Technological Advancements in Material Science: The roofing membrane sector is being transformed by the development of advanced polymer formulations. Modern Thermoplastic Polyolefin (TPO) and Polyvinyl Chloride (PVC) membranes offer heat-weldable seams for superior wind and water resistance. These innovations enhance membrane life expectancy by 15-20 years compared to older technologies. The continuous innovation in reinforcement fabrics and additive packages is driving rapid adoption across the construction, industrial, and logistics sectors, where the demand for low-maintenance, high-performance roofing is relentless and commands a significant project premium.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/167788/global-roofing-membrane-for-flat-or-lowslope-roofs-market-2028-521

Significant Market Restraints Challenging Adoption

Despite their proven benefits, the market faces several hurdles that must be overcome to achieve more widespread adoption.

- Volatile Raw Material Costs and Supply Chain Disruptions: The production of high-quality membranes relies on petrochemical-derived polymers whose prices are subject to global commodity fluctuations. This can elevate material costs by 8-15% year-over-year, posing a significant challenge for project budgeting in cost-sensitive construction segments. Furthermore, the specialized manufacturing processes required to achieve consistent thickness, tensile strength, and weatherability remain a challenge, with quality inconsistencies sometimes affecting up to a tenth of production output, which can impact installation quality and long-term performance.

- Skilled Labor Shortage and Installation Complexity: The correct installation of roofing membranes, particularly techniques like heat welding for TPO and PVC, requires a highly trained workforce. The global construction industry faces a skilled labor deficit exceeding 30% in many developed markets. Current timelines for training and certification of installers can extend from 12 to 24 months, creating a bottleneck for market growth and potentially leading to performance issues if installation is not performed to manufacturer specifications.

Critical Market Challenges Requiring Innovation

The transition from standardized product offerings to customized solutions for specific climate zones and building types presents its own set of challenges. Maintaining performance standards across diverse international building codes is difficult, with varying requirements affecting product acceptance in approximately 20% of potential new markets. Furthermore, ensuring long-term adhesion of seams and termination details in extreme weather conditions is problematic, potentially compromising system integrity in a small percentage of applications. These hurdles necessitate continuous investment in training and installer certification programs, often consuming 5-10% of revenue for leading manufacturers, creating a barrier for smaller, regional players.

Additionally, the market contends with the lifecycle cost perceptions. While membranes offer superior longevity, the higher upfront investment compared to traditional asphalt systems—often 25-35% more—can deter initial adoption from budget-conscious developers, particularly in emerging economies where initial cost is the primary decision driver over lifecycle value.

Vast Market Opportunities on the Horizon

- Green Roof and Photovoltaic System Integration: Roofing membranes now serve as the foundational component for vegetated (green) roofs and solar panel installations. The global solar energy market, projected to reach $2.2 trillion by 2030, presents a massive growth vector. Specially engineered membranes provide the robust, root-resistant base required for green roof substrates, which can reduce urban heat island effect and manage stormwater. Membranes compatible with integrated PV systems, which have shown to increase building energy efficiency by up to 30%, are transforming roofs from passive elements into active contributors to building performance.

- Retrofit and Rehabilitation of Existing Building Stock: The immense inventory of aging commercial and industrial buildings with outdated roofing systems represents a largely untapped market. Early adopters in the retail and manufacturing sectors report ROI periods of 5-7 years based on energy savings and reduced maintenance. The global building renovation market, valued at over $1 trillion, is a prime target for membrane solutions, as they can often be installed directly over existing roof substrates in suitable conditions, effectively reducing project timelines and costs by 20-30% compared to full tear-off.

- Development of Smart and Self-Monitoring Membranes: The market is on the cusp of a digital revolution. Emerging technologies are enabling membranes with integrated sensors to detect and locate moisture ingress in real-time. Recent pilot projects in Europe and North America, demonstrating a 50% reduction in leak-related damage costs, open incredible new possibilities for predictive maintenance in critical infrastructure assets.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into PVC Roofing, TPO Roofing, EPDM Roofing, and others. Thermoplastic Polyolefin (TPO) currently leads the market due to its inherent reflectivity, excellent seam strength via welding, and strong resistance to biological growth and chemicals. EPDM remains a strong contender prized for its proven long-term durability and elasticity in temperature cycling, making it highly suitable for a wide range of climates and building applications. The PVC segment holds a significant share, valued for its long-standing track record and versatility across various project scopes.

By Application:

Application segments are divided between Commercial and Industrial, and Residential. The Commercial and Industrial segment is the undisputed market leader, driven by the sheer scale of low-slope roof area in these sectors. However, the Residential segment, particularly for multi-family apartment complexes and modern architectural homes with flat roof elements, is expected to exhibit a higher growth rate, reflecting modern design trends and the demand for durable, low-maintenance roofing solutions.

By End-User Industry:

The end-user landscape is dominated by the construction and real estate sectors. The Commercial Construction industry accounts for the predominant share, leveraging membranes' properties for large uninterrupted roof planes, energy efficiency, and longevity.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/167788/global-roofing-membrane-for-flat-or-lowslope-roofs-market-2028-521

Competitive Landscape:

The global Roofing Membrane for Flat or Low-Slope Roofs market is moderately consolidated and characterized by intense brand competition and channel dominance. The top three companies—Soprema Group, GAF, and Carlisle—collectively command an estimated 45% of the market share as of 2024. Their leadership is underpinned by deep product portfolios, extensive technical support services, and entrenched relationships with roofing contractors and distributors.

List of Key Roofing Membrane Companies Profiled:

● Soprema Group (France)

● GAF (U.S.)

● Sika (Switzerland)

● Duro-Last (U.S.)

● Johns Manville (U.S.)

● TECHNONICOL Corporation (Russia)

● Firestone (U.S.)

● Carlisle (U.S.)

● CKS (U.S.)

● Versico (U.S.)

● Jianguo Weiye Waterproof (China)

● Hongyuan Waterproof (China)

● FiberTite (U.S.)

● Fosroc (U.K.)

● Bauder (U.K.)

● IB Roof Systems (U.S.)

● Custom Seal Roofing (U.S.)

● Joaboa Technology (China)

● Polyglass (Italy)

● Oriental Yuhong (China)

The competitive strategy is overwhelmingly focused on product innovation for enhanced durability and installation efficiency, alongside forming strategic alliances with large construction management firms and property developers to specify their systems on major projects, therby securing predictable future demand.

Regional Analysis: A Global Footprint with Distinct Leaders

● North America: Is the dominant force, commanding an estimated 48% share of the global market. This leadership is fueled by a mature construction industry, stringent building energy codes, and a high rate of re-roofing activity. The U.S. is the primary engine of growth, supported by a large base of existing commercial buildings requiring roof replacement.

● Europe: Constitutes a major and highly sophisticated market, accounting for approximately 28% of global demand. Europe's strength is driven by advanced sustainability regulations, a strong heritage of flat-roof architecture, and significant investments in building envelope performance.

● Asia-Pacific, Latin America, and MEA: These regions represent the high-growth frontier of the roofing membrane market. While currently smaller in absolute volume, they present exceptional long-term opportunities driven by breakneck urbanization, massive investments in commercial and industrial infrastructure, and a growing emphasis on construction quality and longevity.

Get Full Report Here: https://www.24chemicalresearch.com/reports/167788/global-roofing-membrane-for-flat-or-lowslope-roofs-market-2028-521">

Download FREE Sample Report: https://www.24chemicalresearch.com/reports/167788/global-roofing-membrane-for-flat-or-lowslope-roofs-market-2028-521">

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

● Plant-level capacity tracking

● Real-time price monitoring

● Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/