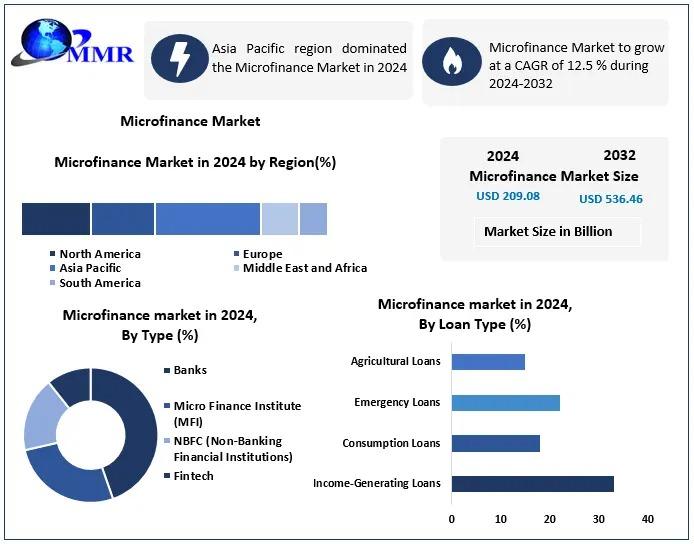

Microfinance Market Regional Insights

The Microfinance Market extends across major global regions—including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa—each contributing differently to the industry’s overall growth. These regions exhibit varied market behaviors shaped by innovation readiness, evolving consumer preferences, supportive regulatory frameworks, and shifting trade environments. While mature markets maintain leadership through advanced technologies and high consumption patterns, emerging economies demonstrate strong growth potential driven by increasing disposable income and rising awareness related to lifestyle and healthcare improvements.

This report delivers a detailed regional analysis, covering key aspects such as import–export flows, government policies, infrastructure development, and macroeconomic influences that shape regional market performance. It highlights the competitive advantages and emerging prospects within each geography, enabling businesses to pinpoint high-value markets and customize their strategies for stronger regional alignment. These localized insights empower stakeholders to make strategic, data-driven decisions that foster long-term growth and capitalize on region-specific opportunities.

Curious about the market dynamics? Get a free sample to explore the latest insights here:https://www.maximizemarketresearch.com/request-sample/230628/

Market Segmentation

by TypeBanks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

by Loan TypeIncome-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

by End UserIndividual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

Some of the leading companies in the Microfinance market include:

1. Bandhan Bank

2. Kiva

3. BRAC

4. Bank Rakyat Indonesia

5. BSS Microfinance Private limited

6. FINCA International

7. Grameen Bank

8. Svatantra microfinance

9. Al Amana Microfinance

10. Grameen Foundation

11. Accion International

12. Opportunity International

13. Bharat Financial Inclusion Limited

14. Cashpor Micro Credit

15. Compartamos Banco

Explore More: Visit our website for Additional reports:

Algorithmic Trading Market https://www.maximizemarketresearch.com/market-report/global-algorithmic-trading-market/29843/

Life Reinsurance Market https://www.maximizemarketresearch.com/market-report/life-reinsurance-market/189286/