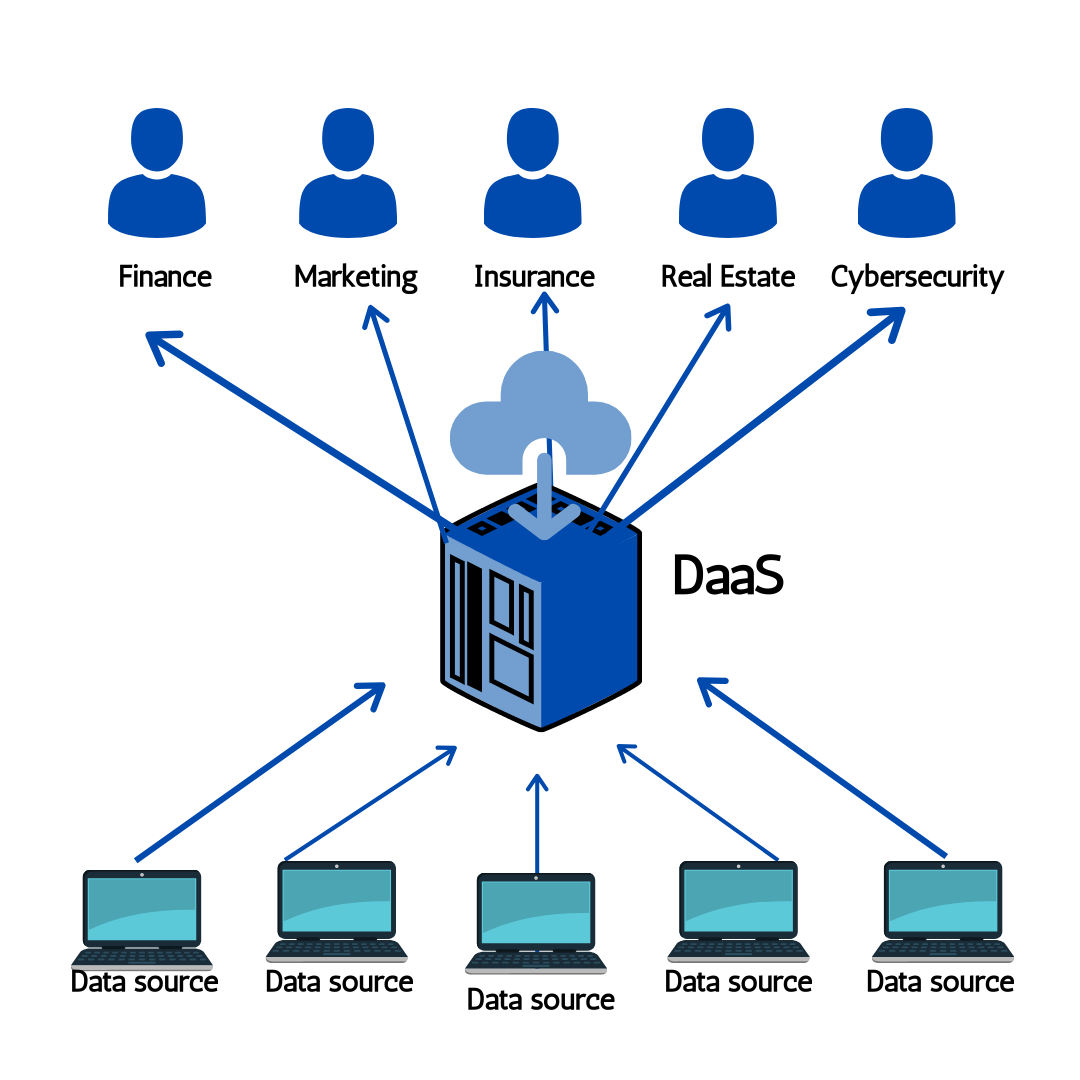

For a new company, entering the sophisticated and increasingly competitive Data as a Service (DaaS) market requires a clever and highly focused entry strategy. A pragmatic analysis of effective Data as a Service (DaaS) Market Entry Strategies reveals that a direct attempt to compete with the broad, generalist datasets of the established giants like Dun & Bradstreet is a high-cost, low-probability endeavor. The most successful entry strategies for newcomers are almost always built on a foundation of extreme niche specialization. This involves identifying, acquiring, and curating a unique dataset that is highly valuable to a specific industry vertical and is difficult for others to replicate. In the data economy, differentiation is everything. The market's immense growth and the ever-expanding universe of data ensure that such niches are constantly emerging. The Data as a Service (DaaS) Market size is projected to grow USD 75.2 Billion by 2035, exhibiting a CAGR of 17.23% during the forecast period 2025-2035. This expansion creates fertile ground for innovative startups to build a highly defensible and profitable business by being the best and only source for a very specific type of data.

One of the most powerful and proven entry strategies is to focus on a new or "alternative" dataset that is not being offered by the major incumbents. The established players are often strong in traditional data types like financial, credit, or basic firmographic data. A new entrant can succeed by finding and productizing a completely new data source. For example, a startup could build a business around collecting and selling data from IoT sensors on global shipping containers to provide real-time supply chain intelligence. Another could use satellite imagery and machine learning to generate data on agricultural crop yields or retail parking lot traffic for financial analysts. A third could specialize in collecting highly specific "technographic" data, identifying which software and technology stacks companies are using. The key to this strategy is to find a dataset that is both proprietary (hard for others to get) and has a clear and compelling use case for a specific set of high-value customers, such as hedge funds or corporate strategists. This allows the new entrant to command premium pricing and build a strong moat based on its unique data asset.

Another highly effective entry strategy is to compete not on the data itself, but on the technology and user experience of delivering it. A new company could enter the market by building a superior, API-first platform with a fanatical focus on the developer experience. While an incumbent data provider might have valuable data, its delivery mechanism could be a clunky, old-fashioned API or a manual file transfer process. A new entrant could win over developers and technical teams by providing an incredibly clean, well-documented, reliable, and easy-to-use API for accessing a similar (or even a less unique) dataset. This "developer-first" approach can create a strong and loyal following. A third strategy is to focus on a specific geographic niche. A new company could aim to become the undisputed best provider of business and consumer data for a specific, fast-growing but underserved region, such as Southeast Asia or Africa. This would involve a deep, on-the-ground investment in local data sourcing and partnerships, creating a level of data quality and granularity for that region that the global providers cannot match. In all cases, the winning strategy for a newcomer is to be narrow, deep, and indispensable for a specific, well-defined audience.

Top Trending Reports -